The Newsmonthly of the American Academy of Actuaries

May 2022

Lisa Slotznick Nominated to Be Academy President-Elect

Lisa Slotznick, who has volunteered in numerous roles for the Academy for more than 20 years including casualty vice president, has been nominated to be the Academy’s next president-elect, as announced by Tom Campbell, immediate past president and chairperson of the Nominating Committee.

Slotznick is currently vice chairperson of the Committee on Qualifications, stepping into that role last June, and also serves as chairperson of the Climate Change Joint Task Force. She is slated to become president-elect at the Academy’s “Envision Tomorrow: 2022 Annual Meeting,” set for Nov. 2–3 in Washington, D.C.

“I am thrilled and honored to be nominated to serve as president-elect of the Academy,” Slotznick said. “Serving as a volunteer for both public policy and professionalism issues has focused my efforts on the Academy’s mission to serve the public and the U.S. actuarial profession. Learning from all those dedicated leaders and volunteers who have brought so much to the Academy and the profession inspires me to want to continually contribute and keep our profession moving forward.”

In addition to being a past casualty vice president, she was a member and chairperson of the Committee on Property and Liability Financial Reporting, chairperson of the Model Audit Rule Practice Note Subgroup, and has served on many Academy committees and work groups including the P/C Extreme Events and Property Lines Committee, the Qualifications Review Panel, the Financial Reporting Committee, and the IFRS 17 Work Group.

Slotznick also received an Outstanding Volunteerism Award in 2015 and was featured in a January 2022 “Actuary Voices” podcast. Slotznick graduated from Bryn Mawr College with a Bachelor of Arts degree in Greek, and recently retired after 42 years as a practicing actuary and more than 33 years as an auditing and consulting actuary in PricewaterhouseCoopers’ property/casualty practice.

“Lisa is an ideal candidate to serve as Academy president,” Campbell said. “She has served in a wide variety of Academy roles, and she brings a breadth of experience in multiple areas of professionalism and public policy, including her current roles on the important Committee on Qualifications and the Climate Change Joint Task Force. She will bring an excellent perspective as president.”

Service Awards Nominations Open

It’s  time to submit nominations for the Academy’s annual awards, which feature a new award this year recognizing young leaders in the actuarial profession. The hard work, dedication, and support of the Academy’s many volunteers help sustain the professionalism infrastructure the Academy provides for our self-regulating profession in the United States and contribute to our work on important public policy issues. Recipients will be recognized at the Academy’s “Envision Tomorrow: 2022 Annual Meeting,” Nov. 2–3 in Washington, D.C.

time to submit nominations for the Academy’s annual awards, which feature a new award this year recognizing young leaders in the actuarial profession. The hard work, dedication, and support of the Academy’s many volunteers help sustain the professionalism infrastructure the Academy provides for our self-regulating profession in the United States and contribute to our work on important public policy issues. Recipients will be recognized at the Academy’s “Envision Tomorrow: 2022 Annual Meeting,” Nov. 2–3 in Washington, D.C.

Members are encouraged to submit nominations for the following awards:

It’s time to submit nominations for the Academy’s annual awards, which feature a new award this year recognizing young leaders in the actuarial profession. The hard work, dedication, and support of the Academy’s many volunteers help sustain the professionalism infrastructure the Academy provides for our self-regulating profession in the United States and contribute to our work on important public policy issues. Recipients will be recognized at the Academy’s “Envision Tomorrow: 2022 Annual Meeting,” Nov. 2–3 in Washington, D.C.

Members are encouraged to submit nominations for the following awards:

- NEW: Rising Actuary Award—This new award recognizes a young leader who’s on the way up in the profession. Through national recognition by the Academy, this award encourages the development and emergence of actuarial leaders 35 years of age or younger, or credentialed 10 years or less as of Jan. 1, 2022. Read more about this new award and how to submit a nomination.

- Robert J. Myers Public Service Award—The Myers award honors an actuary who has made an exceptional contribution to the common good, specifically through a single noteworthy public service achievement or a career devoted to public service. Read more.

- Jarvis Farley Service Award—The Farley award is a lifetime achievement award presented to an actuary whose volunteer efforts on behalf of the Academy have made significant contributions to the advancement of the profession through a lifetime of service. Read more.

- Outstanding Volunteerism Awards—These recognize Academy volunteers who have made a noteworthy contribution during this past year. The Academy may give several of these awards. Read more.

2022 Calendar

June

- June 10: “Value of Reduced Benefit Options in Long-Term Care Insurance Rate Increases,” health webinar (1.2 CE credits)

June 30: “The Revised ASOP No. 28: What You Need to Know,” professionalism/health webinar (1.8 CE credits)

September

Sept. 19–21: Casualty Loss Reserve Seminar, St. Louis

November

Nov. 2–3: “Envision Tomorrow: 2022 Annual Meeting,” Washington, D.C. (registration opening in June)

Nov. 14–17: Life and Health Qualifications Seminar, Arlington, Va. (Up to 27 CE credits)

Events and

Archived Webinars

For a list of previous and upcoming Academy events, please visit the Academy Events Calendar. Also, check out the Academy’s archived webinars, a member benefit, including May’s professionalism, health, and life webinars.

Review Your Membership Profile

To continue receiving Actuarial Update, Contingencies, and other Academy publications on time, please make sure the Academy has your correct contact information. Academy members can update their member profile, subscribe to Academy alerts, pay their dues, and review archived professionalism and public policy webinars at the member login page.

Dues Notice Reminder

Membership in the American Academy of Actuaries indicates recognition in a profession that holds itself to high standards of conduct, practice, and qualification—and that serves the public and the U.S actuarial profession. If you have not done so for 2022, please log in today to renew your membership and continue to access your valuable membership benefits, including receiving Contingencies and Academy alerts, our free library of archived professionalism and public policy webinars, discounts to high-quality educational resources, and satisfaction of legal or regulatory requirements that may be applicable to your practice area and your right to use the MAAA® designation.

Current members who don’t pay their outstanding 2022 membership dues membership will be made inactive in the fall. Then, when they would like to become an Academy member again in the future, they will be required to apply for reinstatement. Per the Academy bylaws, “Reinstatement as a member shall be subject to such conditions as the Board may prescribe.” For questions about dues renewal, reinstatements, dues waivers, steps necessary to submit the required written resignation request, or how to pay over the phone, please don’t hesitate to contact the Academy’s Membership Department at 202-223-8196 or by email at membership@actuary.org.

Early Registration Deadline Approaching for 2022 LHQ Seminar

Register for the Academy’s annual Life and Health Qualifications Seminar, which delivers the highest-quality and most efficient way to obtain any basic education or relevant CE credit necessary—up to 27 hours are available—to qualify to issue actuarial opinions for either the National Association of Insurance Commissioners (NAIC) Life and Accident & Health (A&H) Annual Statement or the NAIC Health Annual Statement. Early registration rates are available through June 30—register now and save $200.

Recently Released

In the May/June Contingencies, read about “The COVID Connection”—how the pandemic has affected (and will continue to affect) the life insurance industry. Also, “The Great Unwinding” covers what happens to the millions of people who became eligible for Medicaid amid the pandemic when the federal public health emergency ends; “Explaining Professionalism to Principals” explains why actuarial professionalism is so important—not just for actuaries, but for all stakeholders involved in actuarial services; and “Thoughts on Social Security,” which offers an intriguing option for reform. Plus, a President’s Message on continued renewal, a Tradecraft selection on a fund found just north of the border, and an Up to Code article on mythology and actuarial professionalism.

read about “The COVID Connection”—how the pandemic has affected (and will continue to affect) the life insurance industry. Also, “The Great Unwinding” covers what happens to the millions of people who became eligible for Medicaid amid the pandemic when the federal public health emergency ends; “Explaining Professionalism to Principals” explains why actuarial professionalism is so important—not just for actuaries, but for all stakeholders involved in actuarial services; and “Thoughts on Social Security,” which offers an intriguing option for reform. Plus, a President’s Message on continued renewal, a Tradecraft selection on a fund found just north of the border, and an Up to Code article on mythology and actuarial professionalism.

In the May/June Contingencies, read about “The COVID Connection”—how the pandemic has affected (and will continue to affect) the life insurance industry. Also, “The Great Unwinding” covers what happens to the millions of people who became eligible for Medicaid amid the pandemic when the federal public health emergency ends; “Explaining Professionalism to Principals” explains why actuarial professionalism is so important—not just for actuaries, but for all stakeholders involved in actuarial services; and “Thoughts on Social Security,” which offers an intriguing option for reform. Plus, a President’s Message on continued renewal, a Tradecraft selection on a fund found just north of the border, and an Up to Code article on mythology and actuarial professionalism.

Academy Joins IABA Corporate Advisory Council

The Academy has joined the Corporate Advisory Council of the International Association of Black Actuaries (IABA). Annette James, chairperson of the Academy’s Health Equity Work Group, attended a virtual meeting of the council on behalf of the Academy. The Academy is pleased to join other leaders in the profession in assisting the IABA in addressing the under-representation of Black actuaries in the profession.

The move augments the Academy’s existing work to grow the current and future pipeline of the actuarial profession, including working with affinity groups to further diversity, equity & inclusion (DE&I) in the profession. In addition, the Academy continues to explore new opportunities to continue serving the diverse needs of its many stakeholders and making improvements to the Academy—providing increased value to the profession, our members, the future pipeline, and our various public stakeholders.

Academy Shares Support for All Impacted by Buffalo Shooting

The Academy released the following statement on the May 14 mass shooting in Buffalo, N.Y.: “The American Academy of Actuaries condemns the tragic shooting in Buffalo and extends our heartfelt condolences to the victims, their families and loved ones, as well as the broader community impacted by this senseless tragedy. The Academy remains committed to fostering an environment of inclusion that embraces our unique differences in all aspects of life and society.”

DEIB Expert Facilitates Strategic Session With Academy Board

Diversity, Equity, Inclusion & Belonging (DEIB) expert Jina Etienne presented to and facilitated a strategic discussion with the Academy’s Board of Directors on May 24. The session on DEIB was one of several strategic discussions in preparation for future-year planning and priority initiatives in support of the Academy’s mission.

CPC, RMFRC Hold ‘Hill Visits’ With Federal Officials

The Academy’s Casualty Practice Council (CPC) and Risk Management and Financial Reporting Council (RMFRC) convened “Hill Visits” in the first week of May—virtual meetings with policymakers on Capitol Hill and federal agencies in the nation’s capital. Topics discussed included cyber risk and cybersecurity, data science, climate change, insurance affordability, flood insurance, financial solvency, and pandemic risk.

CPC and RMFRC volunteers and Academy staff participated in about a dozen meetings with representatives from congressional committees, and federal and congressional agencies including the Congressional Research Service, the Cybersecurity and Infrastructure Security Agency (CISA), the White House Domestic Climate Office, and the U.S. Government Accountability Office.

The CPC’s Cyber Risk Task Force held several meetings, with chairperson Norman Niami and members briefing CISA and a House Homeland Security Committee subcommittee on the Academy’s efforts in cyber risk and cyber security, including the Cyber Risk Toolkit, most recently updated this month.

“The Hill Visits are a great opportunity to introduce the Academy and the RMFRC’s work to federal officials, said Seong-min Eom, Academy vice president, risk management and financial reporting. “We covered many issues … and current insurance or pension block purchase transactions and management activities in the industry.”

“These visits were very productive and underscored the key ways in which actuarial expertise can inform public policy decisionmakers,” said Lauren Cavanaugh, Academy vice president, casualty.

The Academy’s Casualty Practice Council (CPC) and Risk Management and Financial Reporting Council (RMFRC) convened “Hill Visits” in the first week of May—virtual meetings with policymakers on Capitol Hill and federal agencies in the nation’s capital. Topics discussed included cyber risk and cybersecurity, data science, climate change, insurance affordability, flood insurance, financial solvency, and pandemic risk.

CPC and RMFRC volunteers and Academy staff participated in about a dozen meetings with representatives from congressional committees, and federal and congressional agencies including the Congressional Research Service, the Cybersecurity and Infrastructure Security Agency (CISA), the White House Domestic Climate Office, and the U.S. Government Accountability Office.

CPC and RMFRC volunteers and Academy staff participated in about a dozen meetings with representatives from congressional committees, and federal and congressional agencies including the Congressional Research Service, the Cybersecurity and Infrastructure Security Agency (CISA), the White House Domestic Climate Office, and the U.S. Government Accountability Office.

The CPC’s Cyber Risk Task Force held several meetings, with chairperson Norman Niami and members briefing CISA and a House Homeland Security Committee subcommittee on the Academy’s efforts in cyber risk and cyber security, including the Cyber Risk Toolkit, most recently updated this month.

“The Hill Visits are a great opportunity to introduce the Academy and the RMFRC’s work to federal officials, said Seong-min Eom, Academy vice president, risk management and financial reporting. “We covered many issues … and current insurance or pension block purchase transactions and management activities in the industry.”

“These visits were very productive and underscored the key ways in which actuarial expertise can inform public policy decisionmakers,” said Lauren Cavanaugh, Academy vice president, casualty.

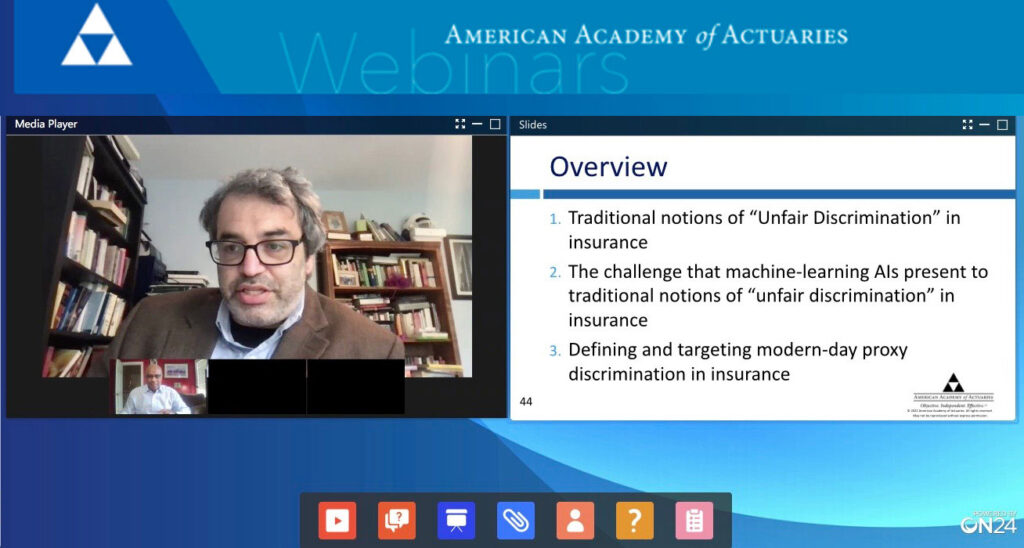

Professionalism Webinar Examines Unfair Discrimination in Insurance

The Academy hosted a May 26 webinar, “What Is Unfair Discrimination in Insurance?” in which presenters explored the current regulatory infrastructure relating to unfair and unlawful discrimination in insurance and the challenges presented by the increased use of big data and artificial Intelligence (AI)-enabled systems.

Presenters were Daniel Schwarcz, an award-winning professor and scholar; former Illinois Director of Insurance Nat Shapo; and Brian Mullen, chairperson of the task force currently revising ASOP No. 12, Risk Classification (for All Practice Areas). General Counsel and Director of Professionalism Brian Jackson moderated.

Mullen opened by providing background on ASOP No. 12. Schwarcz discussed prohibitions on “unfair discrimination”—which occurs when an insurer considers factors unrelated to actuarial risk—in rates and underwriting. He noted that machine learning AI tends to produce the same results as intentional proxy discrimination. As a result, insurance becomes less available and less affordable to individuals because of their race, sex, genetics, health, or income. He also discussed a proposed definition of proxy discrimination, practical tests for proxy discrimination, and the benefits of such a definition.

Shapo gave an overview of the laws related to unfair discrimination and said insurance pricing is cost-based on an economic, not social basis, but with a few exceptions that reflect public judgments about social fairness codified in state statutes.

He said the current core standard of risk-based pricing, supplemented by codified prohibitions and restrictions on individual factors for social fairness reasons, promotes core regulatory norms of objectivity and consistency and protects consumers. Introducing a new core standard with indicia of disparate impact and causation would shift from a codified, objective standard to a subjective regulatory judgment standard at odds with legal and actuarial practice norms and the sound oversight of a business based on predictability, Shapo said.

Slides and audio are available free to Academy members as are archived recordings of all Academy professionalism webinars. Remember—listening to the recorded webinar can satisfy the bias requirement under the U.S. Qualification Standards, and count toward fulling your annually required three hours of continuing education on professionalism topics.

Academy Presents on Professionalism, Public Policy Issues

The buzzing activity of spring included Academy speakers at actuarial meetings across the country—and one at a Canadian event—fanning out to provide actuaries with the latest on public policy and professionalism issues:

Donna Megregian, a member of the Actuarial Standards Board’s Life Committee, spoke at the May 9 meeting of the Actuaries Club of Cincinnati on “Professionalism and Selected ASOP Topics.” She discussed the actuarial standards of practice (ASOP) development process; and ASOPs under review and development; and key concepts such as reliance and documentation.

Committee on Qualifications Vice Chairperson Lisa Slotznick provided a primer for P/C actuaries on the amended USQS to the Casualty Actuaries of the Mid-Atlantic Region’s virtual meeting on May 10. Slotznick conducted an engaging “professionalism challenge,” polling the audience on professionalism issues.

Also on May 10, Academy Assistant Director for Research (Public Policy) Steve Jackson and co-presenter Steve Kolk, chairperson of the Casualty Actuarial Society’s Climate Change Committee, presented at the Actuaries’ Club of Hartford and Springfield (Conn.) on the Actuaries Climate Index and the Actuaries Climate Risk Index. On May 25, Jackson co-presented with Yue (Nina) Chen, executive deputy superintendent of the New York State Department of Financial Services’ Climate Division, on “Managing Climate-Related Financial Risks: Current Status and Future Trends” to the Casualty Actuaries of Greater New York.

Immediate Past President Tom Campbell joined co-presenters from the Canadian Institute of Actuaries (CIA) for a May 11 CIA webinar exploring the amended USQS and its implications for Canadian actuaries. He provided a thorough review of the major requirements of the USQS, the changes that took effect on Jan. 1, and cited key items for Canadian actuaries performing work intended for the U.S.

Academy President-Elect Ken Kent spoke May 12 at the Actuaries Club of Philadelphia on “Ethical Practice—Ethics in Our Work and Profession,” offering a novel approach to exploring the relationship between ethics and the U.S. professionalism structure housed in the Academy.

Academy Senior Pension Fellow Linda K. Stone provided an actuarial perspective in a CNBC personal finance column on rising interest rates and pensions. The column refers readers to the Academy’s Pension Assistance List for free assistance with questions about their pension plans.

Advisor Magazine reported on the Academy’s issue brief highlighting public policy considerations involved in potential modifications to single employer pension plan funding rules.

An automotive blog cited a MarketWatch interview of Senior Casualty Fellow Rich Gibson in a post on electric vehicles.

The Academy’s work in several practice areas was highlighted in a BKD CPAs & Advisors bulletin on March NAIC activity.

A subscriber-only Canine Review article cited a 2018 Contingencies feature story on the pet insurance industry.

Pensions & Investments quoted Joseph Hicks, vice chairperson of the Multiemployer Plans Committee, on the Pension Benefit Guaranty Corporation’s (PBGC) interim rules concerning the federal assistance program for struggling multiemployer funds.

The American Society of Pension Professionals & Actuaries reported on the Academy’s involvement in February’s Intersector Group meeting with the PBGC.

An Engineering News-Record story on the restoration of benefits for an ironworkers’ plan through the PBGC’s Special Financial Assistance program cited the Academy for history of the multiemployer system.

Member Spotlight

Each month, the Academy spotlights an actuary who shares insights about their professional lives, as well as a glimpse into their personal lives. This month profiles Seong-min Eom, the Academy’s vice president, risk management and financial reporting, who received an Academy Outstanding Volunteerism Award in 2019. She talks about her entry into the profession, her approaches to workplace challenges, and her love of the piano. Visit the Member Spotlight page, part of the Academy’s “Professionalism First” hub, to read more about Eom.

Each month, the Academy spotlights an actuary who shares insights about their professional lives, as well as a glimpse into their personal lives. This month profiles Seong-min Eom, the Academy’s vice president, risk management and financial reporting, who received an Academy Outstanding Volunteerism Award in 2019. She talks about her entry into the profession, her approaches to workplace challenges, and her love of the piano. Visit the Member Spotlight page, part of the Academy’s “Professionalism First” hub, to read more about Eom.

This Month in Social Media

The Academy asked “did you know” that a study found that Internet users were likely to reuse or slightly modify passwords across platforms and pointed to the Cyber Risk Toolkit to learn more about this topic.

Stay on top of the latest Academy news by following us on Facebook, Twitter, and LinkedIn. Like what you see? Help spread us the word by liking and sharing our updates.

Professionalism News

Webinar Examines ASOP No. 11 (Life/Health)

The Academy held a professionalism webinar May 12, “The Revised ASOP No. 11: Understanding Important Changes”—the third installment of a webinar series on recently revised actuarial standards of practice (ASOPs) —that examined ASOP No. 11, Financial Statement Treatment of Reinsurance Transactions Involving Life or Health Insurance, which takes effect Dec. 1. Presenters discussed why the standard was revised, highlighted changes practitioners need to be aware of, and walked through case studies from life insurance and health insurance. Webinar slides and audio are available free to logged-in Academy members.

Webinar to Examine Revised ASOP No. 28

In the Academy’s next professionalism webinar, learn all you need to know about changes to Actuarial Standard of Practice (ASOP) No. 28, Statements of Actuarial Opinion Regarding Health Insurance Assets and Liabilities, in this professionalism webinar. Speakers will be ASOP No. 28 Task Force members Donna Novak and Zhe (Gigi) Li. Rick Lassow, past chairperson of the Actuarial Standards Board’s Health Committee, will moderate. The webinar is set for Thursday, June 30, from noon to 1:30 p.m. EDT. Register today.

In ‘Interesting Times,’ the Code Is Essential

Pandemic. War. Inflation. The proverb “may you live in interesting times” certainly seems germane amid today’s headlines.

The last few years have brought increased pressure in many areas of life, whether personal or professional. The Global Business Survey found that in 2020, about a third of U.S. employees agreed that they experienced pressure to compromise their organizations’ workplace ethics standards, up from 16% in 2017. In fact, the survey found that, in 2020, pressure on employees was the highest it had been since 2000. Not surprisingly, the same survey notes that previous research indicates that when pressure increases, observed misconduct also increases.

The Global Business Survey also reports that only one in five employees said they were in workplaces with a strong ethical culture. Luckily for actuaries, the professionalism infrastructure—the Code of Professional Conduct, the U.S. Qualification Standards, the actuarial standards of practice, and the Actuarial Board for Counseling and Discipline—surround actuaries with an ethical framework that supports us in making the right choices even when facing pressure to compromise ethics.

Codes of conduct or ethics are developed to create a strong ethical culture in a profession or organization, and our Code is no different. The Code sets forth what it means for actuaries to act as professionals, identifying the responsibilities that actuaries have to the public, their clients and employers, and the actuarial profession. The Precepts of the Code identify the professional ethical standards that actuaries must comply with to fulfill their responsibility to the public and to the profession.

As noted previously in these pages, maintaining the public’s trust in the actuarial profession is essential to retaining the profession’s self-regulated status. And that trust is earned every day by actuaries upholding the principles and ethics enshrined in the Code of Professional Conduct. Maintaining high levels of integrity, honesty, and competence is always important, of course, but it becomes even more important—and more difficult to do—when facing higher levels of pressure to act in a manner that does not uphold those high standards.

However, the most important reason to uphold these standards is not just to protect self-regulation for the profession, but to protect the ultimate end-users of the products actuaries work on—a homeowner whose house has been destroyed, a driver who has been in an accident, an older person relying on a pension to make ends meet, people in need of healthcare, and those trying to protect their families from the financial calamity the unexpected death of the family breadwinner can bring.

Integrity. Honesty. Competence. There can be no better watchwords for an actuary in these “interesting times.

Casualty News

Cyber Risk Task Force Comments to FIO

The Cyber Risk Task Force (CRTF) sent comments to the U.S. Treasury Department’s Federal Insurance Office on the effectiveness of cyber-related considerations of the Terrorism Risk Insurance Program.

Casualty Briefs

➥ Nathan Luketin joined the Committee on Property and Liability Financial Reporting and the Opinion Seminar Subcommittee.

Life News

Webinar Explores Life Insurance Policy Issues

The Academy hosted “Academy Life Practice Webinar—Spring 2022 Policy Update,” on May 4, which looked at a public policy activity in life insurance issues, such as the work of the NAIC’s new Innovation, Cybersecurity, and Technology (H) Committee; high-yield asset adequacy testing actuarial guideline; the economic scenario generator (ESG) field test; and the Academy model office for ESG testing. Slides and audio are available free to logged-in members.

Group Life Work Group Comments to NAIC

Group Life Waiver Premium Valuation Table Work Group Chairperson Sue Sames presented an update on proposed recommendations to NAIC’s Health Actuarial (B) Task Force on the Group Life Waiver of Premium Valuation Table and Actuarial Guideline XLIV (AG 44).

Life Briefs

➥ Michael Watanabe joined the LPC Diversity, Equity & Inclusion Task Force.

➥ Christine Kaupa joined the Life Experience Committee.

➥ Alan Routhenstein joined the Life Valuation Committee.

Health News

CCIIO Presents at Webinar on 2023 NBPP

The Academy hosted “CCIIO Overview of the HHS Notice of Benefit and Payment Parameters for 2023 Final Rule & Associated Materials” on May 13—a health webinar that featured officials from the Centers for Medicare & Medicaid Services’ (CMS) Center for Consumer Information and Insurance Oversight (CCIIO).

Presenters covered the recently released final 2023 Notice of Benefit and Payment Parameters (NBPP) and other materials including the actuarial value (AV) calculator, letter to issuers, and Quality Rating Informational Bulletin, and took questions from attendees. A webinar recording is available free to logged-in Academy members.

LTC Issue Brief Released; Webinar Set for June 10

The Long-Term Care (LTC) Reform Subcommittee’s LTC Actuarial Equivalence Work Group released a public policy issue brief, “Value of Reduced Benefit Options in Long-Term Care Insurance Rate Increases,” which examines the relationship of benefits to premiums for reduced benefit options (RBOs) in the context of ongoing premium rate increases for LTC insurance. The Academy will host a health webinar of the same name on Friday, June 10, from noon to 1 p.m. EDT. Register today.

Webinar Looks at Health Spending in Wake of COVID-19

The Academy hosted a webinar, “Health Spending Projections in the Wake of COVID-19,” on May 24 that featured presentations by COVID-19 subject-matter experts, including John Poisal, deputy director, National Health Statistics Group, Office of the Actuary, Centers for Medicare & Medicaid Services (CMS); and Regina Rosace, vice president medical director with SCOR Global Life Sciences. They offered information on how the pandemic has affected national health spending and is projected to affect near-term spending, including an overview of newly released CMS national health expenditure projections. Slides and audio are available free to logged-in Academy members.

“Health Spending Projections in the Wake of COVID-19,” on May 24 that featured presentations by COVID-19 subject-matter experts, including John Poisal, deputy director, National Health Statistics Group, Office of the Actuary, Centers for Medicare & Medicaid Services (CMS); and Regina Rosace, vice president medical director with SCOR Global Life Sciences. They offered information on how the pandemic has affected national health spending and is projected to affect near-term spending, including an overview of newly released CMS national health expenditure projections. Slides and audio are available free to logged-in Academy members.

The Academy hosted a webinar, “Health Spending Projections in the Wake of COVID-19,” on May 24 that featured presentations by COVID-19 subject-matter experts, including John Poisal, deputy director, National Health Statistics Group, Office of the Actuary, Centers for Medicare & Medicaid Services (CMS); and Regina Rosace, vice president medical director with SCOR Global Life Sciences. They offered information on how the pandemic has affected national health spending and is projected to affect near-term spending, including an overview of newly released CMS national health expenditure projections. Slides and audio are available free to logged-in Academy members.

Health Briefs

➥ Karin Swenson-Moore joined the Individual and Small Group Markets Committee.

➥ Jeremy Fleischer and Steve Rulis joined the Group Life Waiver Valuation Table Work Group.

➥ Ray Nelson joined the LTC Reform Subcommittee.

Risk Management & Financial Reporting News

Climate Change Task Force Comments to EBSA

The Climate Change Joint Task Force submitted comments to the U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) on possible agency actions to protect life savings and pensions from threats of climate-related financial risk.

IFRS 17 Work Group Comments to IFRS Foundation

The Financial Reporting Committee’s IFRS 17 Work Group submitted comments to the International Financial Reporting Standards (IFRS) Foundation Interpretations Committee on the foundation’s tentative agenda decision, Transfer of Insurance Coverage Under a Group of Annuity Contracts (IFRS 17).

RISK MANAGEMENT BRIEFS

➥ Kyle Stolarz is vice chairperson of the IFRS 17 Work Group.

Upcoming at the Academy

Member Value Survey—The Academy is embarking on a renewed effort to better understand and respond to the evolving needs of its members resulting in enhanced benefits, programs, and products across all Academy channels, all of which contributes to greater value for our members. Watch for a member value survey that invites you to share your voice and perspectives with the Academy, which will help us better serve you.

Trustees’ reports webinar—Following the expected release soon of the annual Medicare and Social Security trustees’ reports, this webinar will feature chairpersons of the Academy’s Medicare and Social Security Committees, who will summarize the trustees’ findings. Prominent actuaries from the two programs will provide a deeper dive into the assumptions used and explore how recent events—such as the COVID-19 pandemic and related economic downturn—are reflected in the projections.

Editor

Michael G. Malloy

Assistant Director of Communications for Content

Eric P. Harding

Design and Production

BonoTom Studio Inc.

Designer

Christopher Specht

Creative Lead

Laurie Young

President

Maryellen Coggins

President-Elect

Ken Kent

Secretary-Treasurer

Cathy Murphy-Barron

Vice Presidents

Al Bingham

Lauren Cavanaugh

Sherry Chan

Seong-min Eom

Al Schmitz

Benjamin Slutsker

Executive Director

Bill Michalisin

Director of Communications

David J. Nolan

Executive Office

American Academy of Actuaries

1850 M Street, NW

Suite 300

Washington, DC 20036

Phone: 202-223-8196

Fax: 202-872-1948

www.actuary.org

Statements of fact and opinion in this publication, including editorials, are made on the responsibility of the authors alone and do not necessarily imply or represent the position of the American Academy of Actuaries, the editors, or the members of the Academy.

©2022 The American Academy of Actuaries. All rights reserved.